Market demand may increase the stock price, which results in a large divergence between the market and book values per share. Book value per share is just one of the methods for comparison in valuing of a company. Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast. For example, enterprise value would look at the market value of the company’s equity plus its debt, whereas book value per share only looks at the equity on the balance sheet.

How to Interpret BVPS?

SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). This means that each share of the company would be worth $8 if the company got liquidated. Now, let’s say that you’re considering investing in either Company A or Company B. Given that Company B has a higher book value per share, you might find it tempting to invest in that company. However, you would need to do some more research before making a final decision. Alternatively, another method to increase the BVPS is via share repurchases (i.e. buybacks) from existing shareholders.

What Does Book Value Per Share (BVPS) Tell Investors?

The difference between book value per share and market share price is as follows. BVPS is more relevant for asset-heavy companies, such as manufacturing firms, where physical assets constitute a significant portion of the balance sheet. BVPS is typically calculated quarterly or annually, coinciding with the company’s financial reporting periods. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

How does BVPS differ from market value per share?

Therefore, the market value, which is determined by the market (sellers and buyers) and represents how much investors are willing to pay after accounting for all of these factors, will generally be higher. Book value per common share (or, simply book value per share – BVPS) is a method to calculate the per-share book value of a company based on common shareholders’ equity in the company. The book value of a company is the difference between that company’s total assets and total liabilities, and not its share price in the market. The book value per share (BVPS) ratio compares the equity held by common stockholders to the total number of outstanding shares. To put it simply, this calculates a company’s per-share total assets less total liabilities. The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. As demonstrated in this example, many investors believe that B is a better-valued firm xero promo code coupons february 2021 by anycodes because of its relatively lower P/B ratio. The answer is yes because the company can be punished/pushed unfairly by the market due to stated book value that may not represent the actual value of its assets.

As a result, a high P/B ratio would not necessarily be a premium valuation, and conversely, a low P/B ratio would not automatically be a discount valuation when comparing companies in different industries. If the market price for a share is higher than the BVPS, then the stock may be seen as overvalued. In other words, investors understand the company’s recent performance is underwhelming, but the potential for a long-term turnaround and the rock-bottom price can create a compelling margin of safety.

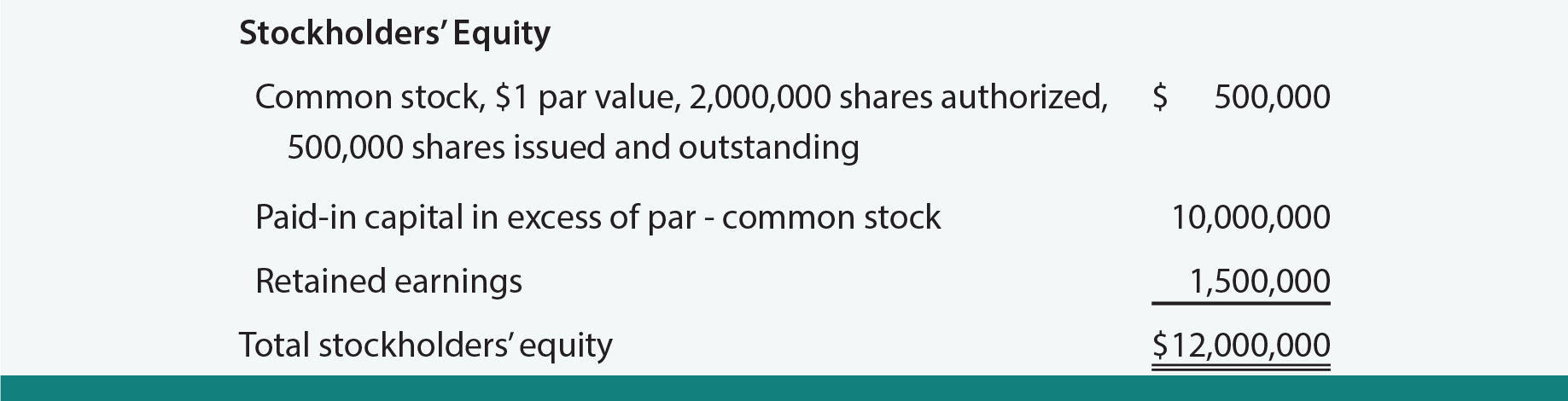

In simple words, book value is the sum available for shareholders in case a company gets liquidated. The figure that represents book value is the sum of all of the line item amounts in the shareholders’ equity section on a company’s balance sheet. As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets.

The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities.

- As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q).

- The P/B ratio also provides a valuable reality check for investors seeking growth at a reasonable price.

- Second, the net worth of an organization’s assets must be ascertained by investors.

- The book value of a company is the difference between that company’s total assets and total liabilities, and not its share price in the market.

It is the amount that shareholders would receive if the company dissolves, realizes cash equal to the book value of its assets and pays liabilities at their book value. Now, let’s say that Company B has $8 million in stockholders’ equity and 1,000,000 outstanding shares. Using the same share basis formula, we can calculate the book value per share of Company B. In the example from a moment ago, a company has $1,000,000 in equity and 1,000,000 shares outstanding. Now, let’s say that the company invests in a new piece of equipment that costs $500,000. The book value per share would still be $1 even though the company’s assets have increased in value.