By optimizing pricing strategies to reach the break-even point sooner, companies can enhance profitability. Typically, the first time you reach what is business process improvement bpi a break-even point means a positive turn for your business. When you break-even, you’re finally making enough to cover your operating costs.

Contribution Margin Method (or Unit Cost Basis)

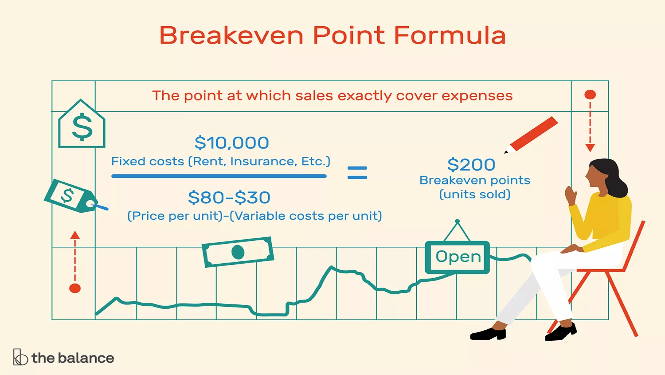

In other words, it is used to assess at what point a project will become profitable by equating the total revenue with the total expense. Another very important aspect that needs to address is whether the products under consideration will be successful in the market. The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured.

What is the approximate value of your cash savings and other investments?

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Part 2: Your Current Nest Egg

According to this formula, your break-even point will be $200,000 in sales revenue. This analysis shows that any money generated over $200,000 will be net profit. Calculating your company’s break-even point is important to the overall health of your business. It can be used to make informed decisions and develop a long-term business plan for your company’s future success. But first, you’ll need to know how to perform a break-even analysis.

A break-even analysis allows you to determine your break-even point. Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. This is a great example of how selling a product for a higher price allows you to reach the break-even point significantly faster. However, you need to think about whether your customers would pay $200 for a table, given what your competitors are charging. At the break-even point, you’ve made no profit, but you also haven’t incurred any losses. This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

- A higher contribution reduces the number of units needed to break even because each unit contributes more towards covering fixed costs.

- First we take the desired dollar amount of profit and divide it by the contribution margin per unit.

- They can also change the variable costs for each unit by adding more automation to the production process.

- In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives.

- At this level of sales, ABC Ltd will not make any profit but will just break even.

- Examples of variable costs include direct materials and direct labor.

When it comes to securing investors, especially starting out, they want to see that you’ve done your homework and understand how your business will make money. It shows potential investors how much you need to sell to cover your costs and when they can expect to see returns on their investment. Break-even analysis can help determine those answers before you make any big decisions. For example, if the demand for your product is smaller than the number of units you’ll need to sell to breakeven, it may not be worth bringing the product to market at all. Finding your break-even point gives you a better idea of which risks are really worth taking. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin.

Another limitation is that the breakeven point assumes that sales prices, variable costs per unit, and total fixed costs remain constant, which is often not the case. The price of goods sold at fluctuates, and the cost of raw materials may hardly stay stable. In addition, changes to the relevant range may change, meaning fixed costs can even change.

For instance, if management decided to increase the sales price of the couches in our example by $50, it would have a drastic impact on the number of units required to sell before profitability. They can also change the variable costs for each unit by adding more automation to the production process. Lower variable costs equate to greater profits per unit and reduce the total number that must be produced.