Conversely, if the market value per share exceeds BVPS, the stock might be perceived as overvalued. BVPS offers a baseline, especially valuable for value investors looking for opportunities in underpriced stocks. The company’s past financial statements will help you find out the depreciated values. Investors find the P/B ratio useful because the book value of equity provides a relatively stable and intuitive metric they can easily compare to the market price. This illustrates that the market price is valued at twice its book value, which may or may not indicate overvaluation.

What Is Book Value Per Common Share?

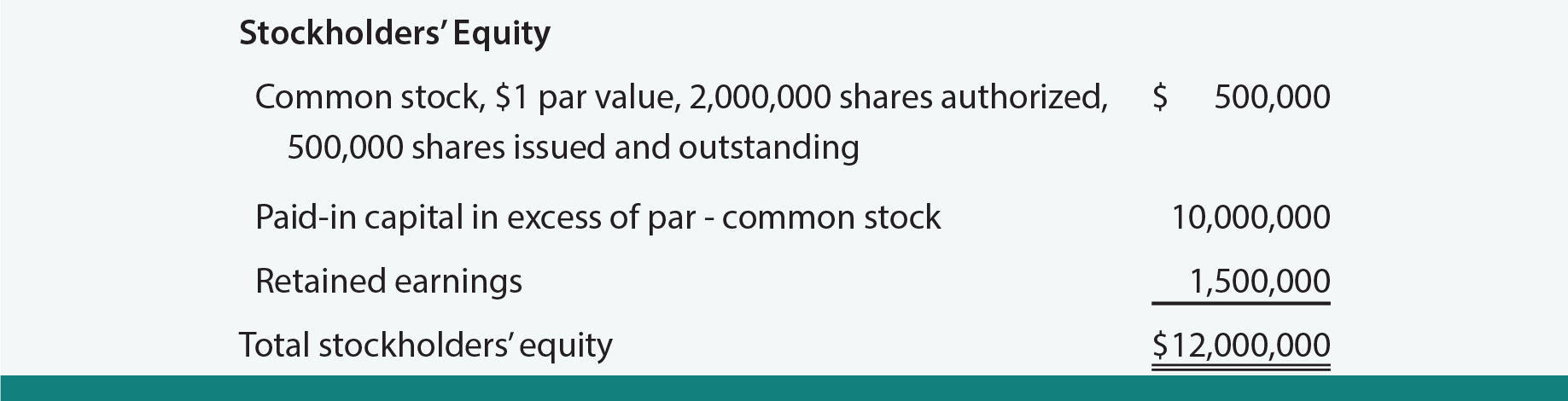

This formula shows the net asset value available to common shareholders, excluding any preferred equity. Book Value Per Share is calculated by dividing the total common equity by the number of outstanding shares. Second, the net worth of an organization’s assets must be ascertained by investors.

Price-To-Book Ratio

- It is difficult to pinpoint a specific numeric value of a “good” price-to-book (P/B) ratio when determining if a stock is undervalued and therefore, a good investment.

- Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation.

- A company’s stock buybacks decrease the book value and total common share count.

- Investors use BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

- The market value of a company is based on the current stock market price and how many shares are outstanding.

But an important point to understand is that these investors view this simply as a sign that the company is potentially undervalued, not that the fundamentals of the company are necessarily strong. The difference between a company’s total assets and total liabilities is its net asset value, or the value remaining for equity shareholders. BVPS represents the accounting value of each share based on the company’s equity, while the market value per share is determined by the stock’s current trading price in the market. If a company’s BVPS is higher than its market value per share (the current stock price), the stock may be considered undervalued. This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth. The company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, its common equity increases along with BVPS.

P/B Ratios and Public Companies

Yes, if a company’s liabilities exceed its assets, the BVPS can be negative, signaling potential financial distress. Value investors use BVPS to identify stocks that are trading below their intrinsic value, indicating potential undervaluation. While Book Value Per Share can be a helpful indicator of a company’s tangible net assets, it has several limitations that investors should be aware of. Intangible assets can be items such as patents, intellectual property, and goodwill.

These methods would increase the common equity available to shareholders, and hence, raise the BVPS. Whereas some price models and fundamental analyses are complex, calculating book value per share is fairly straightforward. At its core, it’s subtracting a company’s preferred stock from shareholder equity and dividing that sum by the average amount of outstanding shares. Book value per share is determined by dividing common shareholders’ equity by total number of outstanding shares.

Repurchase Common Stocks

Assume that a company has $100 million in assets on the balance sheet, no intangibles, and $75 million in liabilities. Therefore, the book value of that company would be calculated as $25 million ($100 million – $75 million). An investor can apply BVPS to a stock by analyzing the company’s balance sheet. Specifically, an investor will need total asset value, cost of acquiring an asset, and accumulated depreciation of corporate assets which helps provide the most accurate BVPS figure. If the company’s BVPS increases, investors may consider the stock more valuable, and the stock’s price may increase.

Investors use BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. Book value refers to a firm’s net asset value (NAV) or its total assets minus its total liabilities. Price-to-Book ratio or PB ratio is a common financial indicator for helping investors determine the company’s worth. Investors can use the PB ratio to evaluate if a stock is overpriced or undervalued to its book value. For investors looking for stocks that are trading below their actual value, it’s a useful tool.

For instance, consider a company’s brand value, which is built through a series of marketing campaigns. U.S. generally accepted accounting principles (GAAP) require marketing costs to be expensed guide to the nanny tax for babysitters and employers immediately, reducing the book value per share. However, if advertising efforts enhance the image of a company’s products, the company can charge premium prices and create brand value.