For example, let’s say a customer negotiated and agreed to a four-year contract for a subscription service for a total of $50,000 over the contract term. Combine bottoms-up and top-down forecasts for a comprehensive view of potential ARR growth. Use financial ratios to understand the impact of expansion, downgrade, and churn. Consider the revenue received but not yet earned, also known as deferred revenue. Understanding the importance and role of ARR in a business is the first step.

What Is the Accounting Rate of Return Useful For?

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

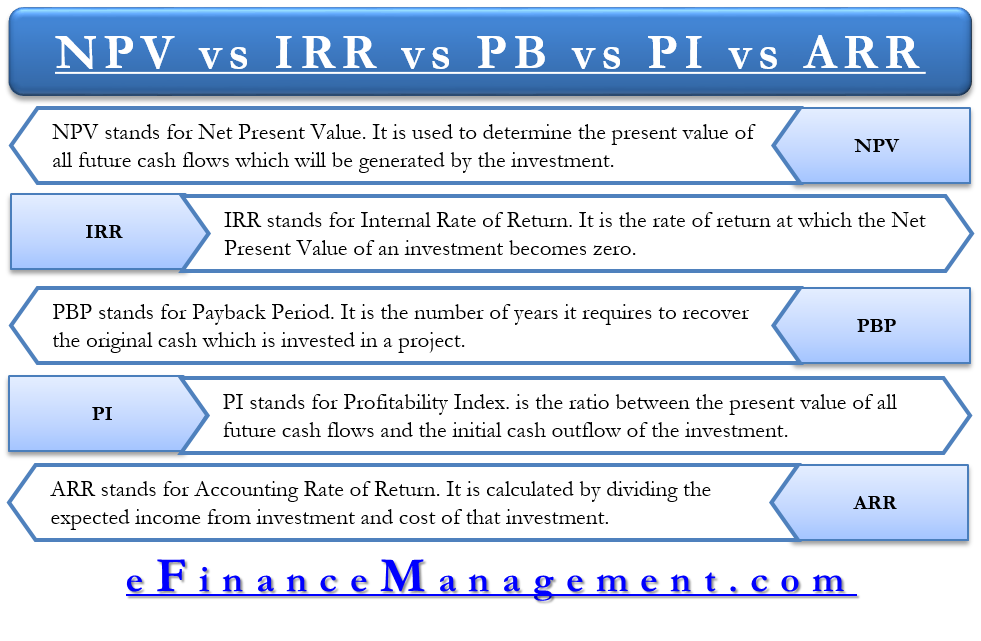

Risk of profitability misinterpretation

Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow. The annual recurring revenue (ARR) reflects only the recurring revenue component of a company’s total revenue, which is indicative of the long-term viability of a SaaS company’s business model. Whether it’s purchasing property, investing in a new software training program, or expanding into a new market, there are many investment decisions that businesses must make.

Example: simple rate of return method with salvage value

They are now looking for new investments in some new techniques to replace its current malfunctioning one. The new machine will cost them around $5,200,000, and by investing in this, it would increase their annual revenue or annual sales by $900,000. Specialized staff would be required whose estimated wages would be $300,000 annually.

Calculating ARR

You are aware of common errors like misinterpreting revenue and overlooking the churn rate. You might want to schedule a demo to see how Togai can help you implement your subscription strategies effectively. The ARR formula calculates the return or ratio that may be anticipated during the lifespan of a project or asset by dividing the asset’s average income by the company’s initial expenditure. The present value of money and cash flows, which are often crucial components of sustaining a firm, are not taken into account by ARR.

How to calculate Accounting Rate of Return in Excel?

This is when it is compared to the initial average capital cost of the investment. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. Since ARR is based solely on accounting profits, ignoring the time value of money, it may not accurately project a particular investment’s true profitability or actual economic value. In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability.

For a project to have a good ARR, then it must be greater than or equal to the required rate of return. The company may accept a new investment if its ARR higher than a certain level, usually known as the hurdle rate which already approved by top management and shareholders. It aims to ensure that new projects will increase shareholders’ wealth for sustainable growth.

The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage. The RRR can vary between investors as they each have a different tolerance for risk. For example, a risk-averse investor requires a higher excel templates rate of return to compensate for any risk from the investment. Investors and businesses may use multiple financial metrics like ARR and RRR to determine if an investment would be worthwhile based on risk tolerance. The time value of money is the main concept of the discounted cash flow model, which better determines the value of an investment as it seeks to determine the present value of future cash flows.

- Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value.

- Accounting Rates of Return are one of the most common tools used to determine an investment’s profitability.

- So, in this example, for every pound that your company invests, it will receive a return of 20.71p.

- Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period.

This way, you avoid any interruption in your cash flow by ensuring you don’t provide products and services to these customers until they settle their overdue payments. Free trials are another factor that should not be included in the ARR calculation. They do not contribute to recurring revenue, and their inclusion could lead to errors.